Bankruptcy and Your Credit Report After Discharge

Filing for bankruptcy is a great way for some people to get their lives back on track by discharging many, if not all, of their debts. Chances are, if you are thinking about filing for bankruptcy or have already filed, your credit score is not where you want it to be. The good news is that bankruptcy can get you well on the way towards rebuilding your credit score.

Filing for bankruptcy is a great way for some people to get their lives back on track by discharging many, if not all, of their debts. Chances are, if you are thinking about filing for bankruptcy or have already filed, your credit score is not where you want it to be. The good news is that bankruptcy can get you well on the way towards rebuilding your credit score.

So, your debts have been discharged, but that will not do you much good if those debts still show up on your credit report. Today, we want to talk about some steps to take when it comes to your credit score after bankruptcy.

What Is Your Credit Score?

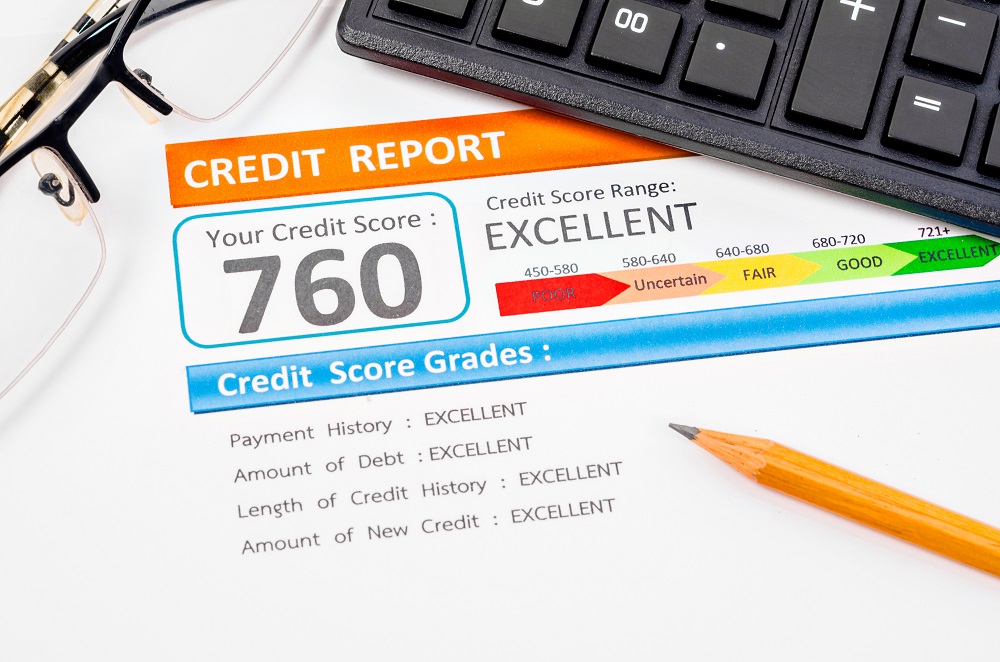

Your credit score is the three-digit number that is a snapshot of the information on your credit report. Your credit report is based on your past and current financial history. Included in your score are:

- Payment history

- Amount owed

- Length of credit history

- Types of credit

- New accounts and inquiries

That is extensive and can include various types of debts:

- Credit card

- Mortgage

- Medical bills

- Student loans

- Unpaid utilities

- Vehicle loans

- Bankruptcy filings

- And more

Your credit score is extremely important because it determines how creditors treat you when you need to borrow money. With a high credit score, a person can obtain higher amounts with lower interest rates. A lower score can mean lower borrowing capacities and high interest rates. It can even mean a flat out refusal from a creditor.

During And After Bankruptcy

If you are filing for bankruptcy, your credit score is probably fairly low. That is okay because most people who file and get their debts discharged begin to rebuild their credit fairly quickly. However, after your debts are gone, you need to keep an eye on your credit report to ensure that it reflects the discharge.

By law, you have access to your credit report for free from the three major reporting bureaus. For this free report, you can view your credit history, but not your credit score (that costs a fee). Take advantage of this and scan your report throughout the year after filing for bankruptcy.

*Note: there are also many companies that allow you to check your report AND score for free anytime. The downside is that you will receive offers for credit cards and other loans in the mail regularly (hey, nothing is free).

If you see a debt on your report that should be listed at discharged and at $0.00, but it is still showing as being owed and with an amount, you can dispute it. This is where it will be helpful to get your attorney involved (preferably the one who helped with your bankruptcy) to help draft the disputes. An attorney knows that language to use and will likely be more successful.

In some cases, you may need to file a lawsuit to fix the problem. You will find that many attorneys take these cases on contingency because the three credit bureaus pay the costs and attorney’s fees for lawsuits if they are necessary to fix a score.

What To Do Now

Please seek assistance from an Arizona bankruptcy attorney if you are considering filing for bankruptcy. This process is complicated and you need to ensure that everything is done correctly. Most people can get through bankruptcy in a few months, but that does not mean your credit report will reflect the discharged debt.

We hope you take the steps we mentioned above so that you can truly begin the rebuilding process.

Find out why a bankruptcy 341 hearing is no big deal.